Crypto markets show 'quiet strength' as bitcoin exchange balances reach multi-year lows: analysts

Quick Take

- Bitcoin has held above $93,000 as exchange balances fall toward multi-year lows, tightening supply conditions.

- Ethereum rallied past $3,200 on strong post-Fusaka flows and renewed shark-wallet accumulation.

- Analysts say a net-positive liquidity backdrop is forming for the first time since early 2022.

Bitcoin held above $93,000 on Thursday as onchain data pointed to continued supply leaving centralized exchanges. Liquidations also eased sharply compared to the week’s earlier volatility.

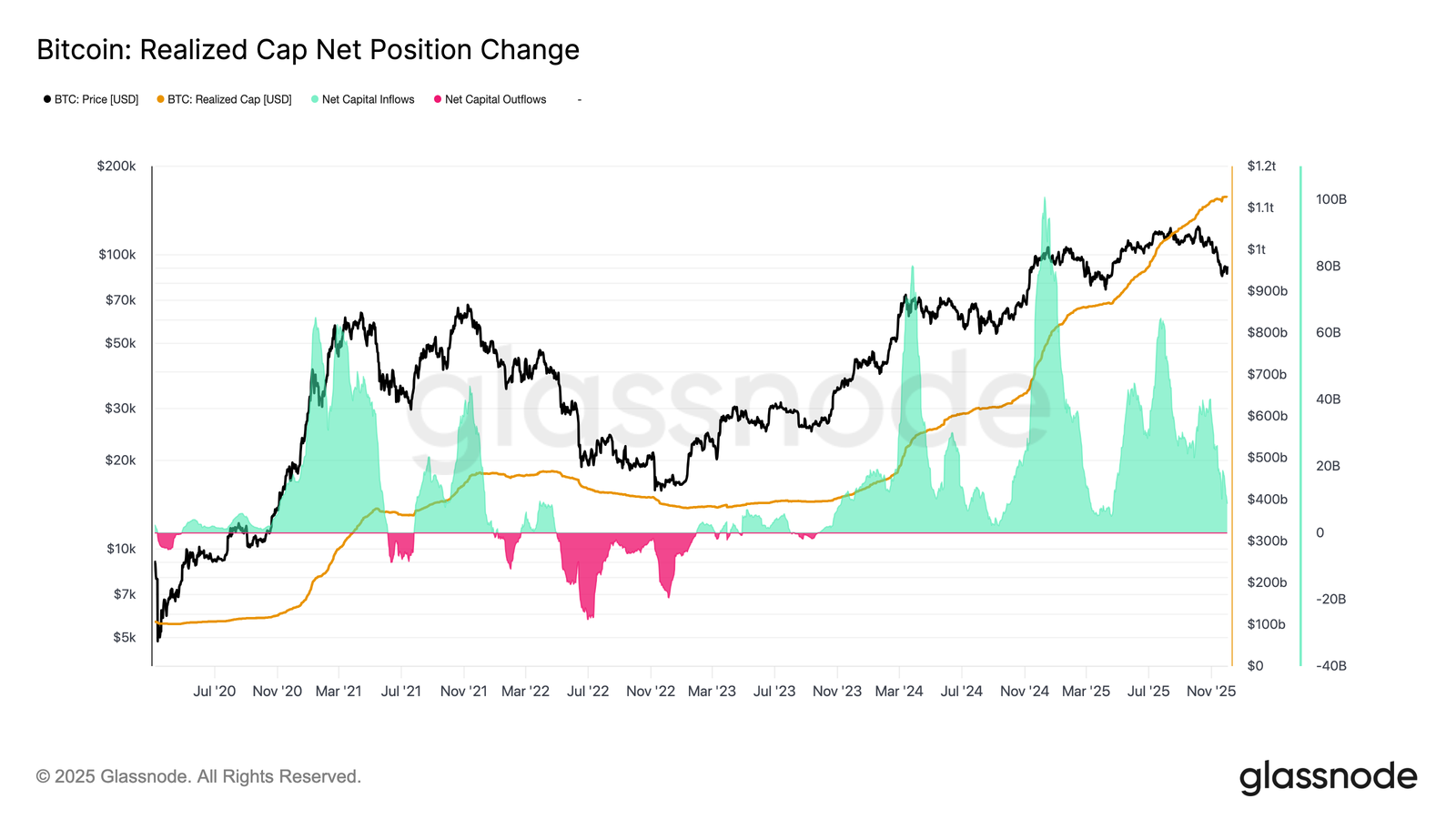

BRN Research analysts said Bitcoin’s underlying structure has improved steadily despite muted spot momentum. Timothy Misir, BRN's head of research, noted that exchange balances have fallen to roughly 1.8 million BTC, the lowest level since 2017, based on aggregated CryptoQuant and Glassnode data. He added that realized-cap growth remains positive on a monthly basis, suggesting that fresh capital continues to enter BTC even as the broader market trades within a tightening range.

“The market opened with quiet strength,” Misir said. “Accumulation is persistent, supply is thinning on exchanges, and price is stabilizing above the True Market Mean. What’s missing is a clean break into the $96K–$106K band.”

Bitcoin Realized Cap Net Position change | Image: Glassnode

ETH leads majors as network activity climbs

Ethereum outpaced BTC for a second straight session.

Misir pointed to renewed accumulation from “shark” wallets holding 1,000–10,000 ETH and daily network growth that briefly approached 190,000 in new addresses following the Fusaka upgrade. “Shark wallets holding 1,000–10,000 ETH have resumed aggressive accumulation, historically one of the strongest leading flows for ETH outperformance,” he stated in a Dec. 4 note. “Network growth touched 190,000 new addresses in a single day, indicating genuine organic expansion post-Fusaka.”

Meanwhile, Solana and BNB traded mixed but stable, while the overall crypto market capitalization hovered near $3.2 trillion.

ETF flows flip mixed as BTC pauses, ETH attracts capital

U.S. spot Bitcoin ETFs posted a small $14.9 million net outflow on Dec. 3, ending five days of inflows, according to The Block’s data. BlackRock’s IBIT remained the strongest individual product, adding $42.24 million on the day.

Spot Ether ETFs saw a significantly stronger session with $140 million in net inflows, while U.S. Solana ETFs recorded $32.19 million in outflows.

Liquidations ease after earlier volatility

Market positioning has continued to normalize following Monday’s sharp correction. Data from CoinGlass shows just over $312 million in total liquidations over the past 24 hours. That’s substantially lower than the multibillion-dollar spikes seen earlier in the week.

Roughly $202 million of the wiped positions were shorts, and an estimated $110 million were longs, indicating more cautious leverage on both sides as BTC consolidates near resistance.

Notably, exchanges release staggered liquidation data, which means the actual figures for today may be higher than reported.

Macro backdrop turns incrementally supportive

A mixed macro landscape persisted, but experts say conditions are slowly tilting toward a more constructive liquidity profile. The U.S. Treasury executed a record $13.5 billion debt buyback this week, adding incremental liquidity to the system.

Delphi Digital noted the Federal Reserve should deliver another 25-bp rate cut in December, bringing the fed funds rate into the 3.50%–3.75% range. Indeed, the CME FedWatch tool and prediction venues like Polymarket show a 90% likelihood of lower funding rates after next week's Federal Reserve meeting.

The forward curve now also prices at least three additional cuts through 2026. Additionally, the end of quantitative tightening on Dec. 1, a drawdown in the Treasury General Account, and a fully depleted RRP facility create the first net-positive liquidity backdrop since early 2022.

“Policy is shifting from a headwind to a mild tailwind,” Delphi wrote in an X post, adding that the environment favors “large caps, gold and digital assets with structural demand.”

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.