Bitcoin treasury XXI shares sink 20% in NYSE debut despite rising BTC price

Quick Take

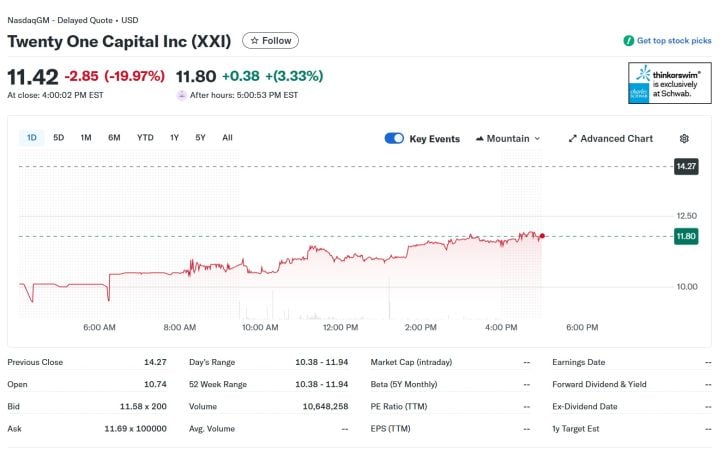

- Shares of the newly listed company were trading at $11.42 at market close on Tuesday, about 20% below the $14.27 closing price of the Cantor Equity Partners SPAC it merged with.

- Twenty One Capital CEO Jack Mallers said the firm is looking to build revenue-generating Bitcoin-only businesses in brokerage, credit, and lending.

Twenty One Capital, the Tether-backed bitcoin treasury venture led by Strike founder Jack Mallers, fell sharply in its first day of trading on Tuesday, even as bitcoin climbed roughly 3%.

Shares of the newly listed company, trading under ticker XXI, opened at $10.74 and finished at $11.42, about 20% below the $14.27 closing price of the Cantor Equity Partners SPAC it merged with. The stock edged up to $11.80 in post-market trading.

Twenty One Capital (XXI) stock price chart. Source: Yahoo Finance

The listing caps a months-long effort to take Twenty One public through a Cantor Fitzgerald–backed SPAC, with Tether and SoftBank contributing bitcoin as part of the deal.

The company enters the market holding 43,514 BTC worth over $4.05 billion, ranking it third among the largest public corporate holders, according to The Block data.

On CNBC Tuesday, Mallers pushed back against comparisons of Twenty One to pure bitcoin treasury plays like Michael Saylor's Strategy, the current treasury top dog, which holds over $61.5 billion in BTC.

He argued that while Twenty One will keep accumulating bitcoin, the firm is also trying to build revenue-generating Bitcoin-only businesses in brokerage, credit, and lending.

“We look at a Coinbase and don’t think they’re a Bitcoin business. They’re a crypto business. We look at Strategy that’s focused on Bitcoin but doesn’t have products or cash flow in the industry,” Mallers said. “We want to live in the intersection of that.”

The SPAC deal brought in roughly $850 million through a mix of convertible notes and equity sales — part of a broader capital package that included earlier bitcoin contributions from Tether, SoftBank, and Bitfinex. Those firms collectively supplied several billion dollars’ worth of bitcoin when Twenty One was formed this past spring.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.